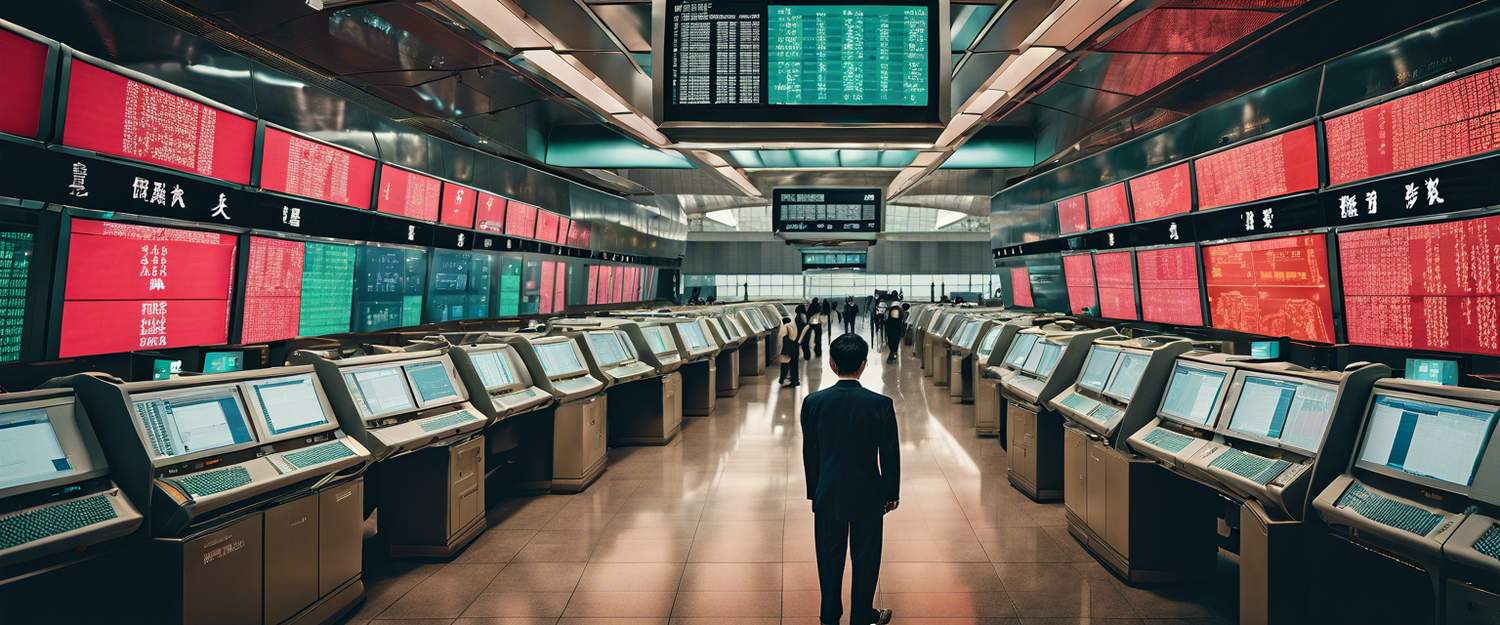

Hong Kong Stock Exchange Expands Virtual Asset Products

The Hong Kong Stock Exchange (HKEX) has recently made headlines by significantly enhancing its offerings in the realm of virtual asset Exchange-Traded Products (ETPs). With a new total of ten products available, which includes a diverse range of ETFs, leveraged, and inverse products, the expansion indicates a robust growth trajectory for the financial markets in Hong Kong.

Forecast for Growth in 2024

The ETP market in Hong Kong is poised for continued expansion throughout 2024. Investors can expect a variety of new thematic ETFs that will focus on emerging sectors such as artificial intelligence, automation, digital payments, and Web3 technologies. These products aim to provide leveraged exposure to burgeoning industries, resonating with the growing interest in technological advancements and digital innovations.

Launching Asia’s First Inverse Bitcoin Product

This year's highlight includes the introduction of Asia's first inverse Bitcoin product, which was listed in July. This innovative ETP allows investors to engage with Bitcoin price movements through inverse trading strategies, marking a significant milestone in the region’s asset offerings. As cryptocurrency becomes increasingly influential in investment portfolios, such products provide additional strategic avenues for traders.

Significant Market Growth

The virtual asset ETP market in Hong Kong has witnessed remarkable growth. Following the launch of Asia’s first six virtual asset spot ETFs in April 2024, alongside the initial three virtual asset futures ETFs that hit the market in late 2022 and early 2023, the market capitalization surged to over HK$3.2 billion by the end of August. Such figures reflect the escalating demand and acceptance of cryptocurrency-related financial instruments.

Hong Kong’s Position as a Financial Hub

As the first Asian market to introduce virtual asset ETPs, Hong Kong is fortifying its role as a vital financial hub for cryptocurrency investment products. The HKEX's comprehensive selection of virtual asset ETFs is poised to draw interest from both institutional and retail investors alike, further propelling the growth and maturity of the region’s crypto-financial landscape.

Conclusion

In conclusion, the HKEX’s strategic expansion into virtual asset ETPs marks a pivotal development for Hong Kong’s financial markets. By continually offering innovative financial products, the exchange is likely to foster an environment conducive to investment in cryptocurrencies and related technologies, thus a promising future awaits the Hong Kong ETP market.

Call to Action

If you’re interested in exploring the latest trends in cryptocurrency investment products, stay updated with HKEX’s announcements and market developments.

发表评论

所有评论在发布前都会经过审核。

此站点受 hCaptcha 保护,并且 hCaptcha 隐私政策和服务条款适用。