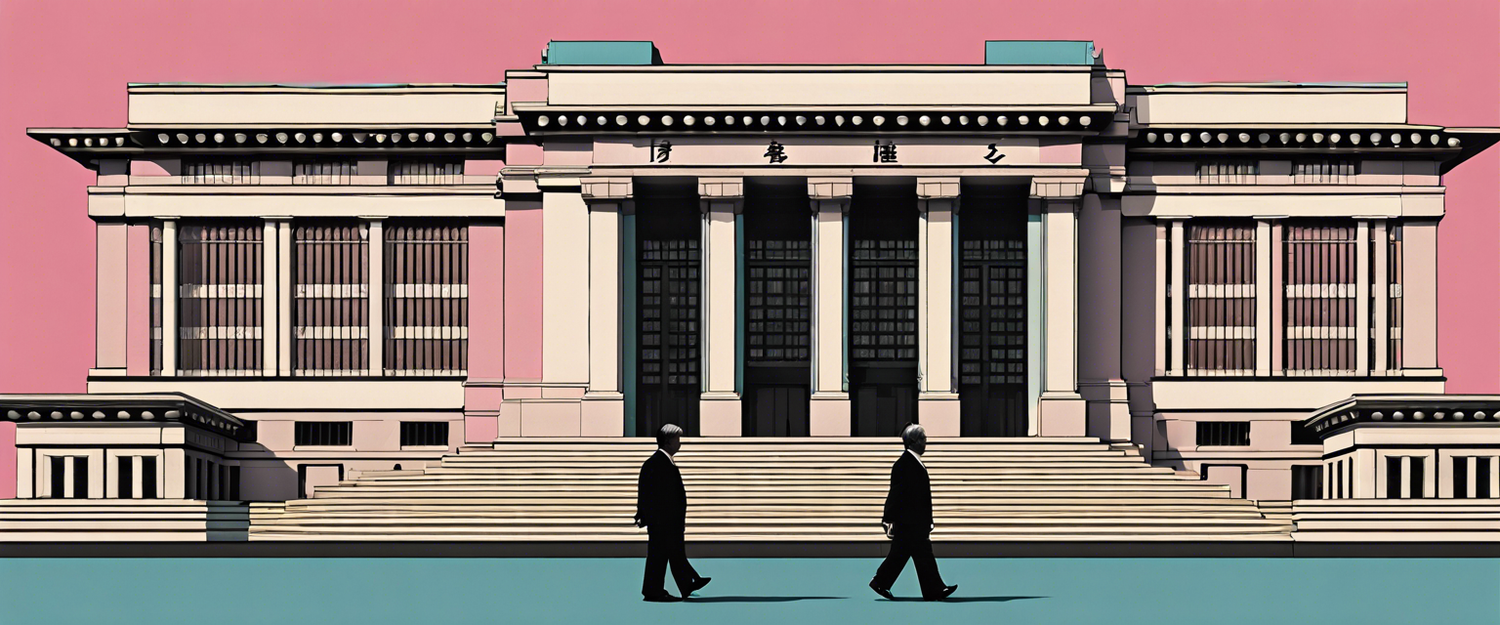

Bank of Japan's Stance on Interest Rates Amid Rising Trend Inflation

In recent statements made by Bank of Japan (BOJ) Governor Kazuo Ueda, the need for potential interest rate hikes has been underscored in response to anticipated trends in inflation. Ueda's remarks are significant not just for the Japanese economy but also for global markets, indicating a shift in monetary policy considerations.

Understanding Trend Inflation and Its Implications

Trend inflation refers to the long-term movement of prices, indicating the general direction where inflation rates are headed. According to Ueda, if trend inflation continues to rise as forecasted, this may necessitate adjustments in monetary policy, particularly an increase in interest rates. This approach aligns with the BOJ's commitment to ensuring price stability and promoting sustainable economic growth.

Governor Ueda's Forecast and Policy Approach

Governor Ueda has emphasized that should the economic indicators and price trends correlate with the projections laid out in the BOJ's quarterly outlook report, the central bank will not hesitate to implement a rate hike. This conditional approach showcases the bank's focus on evidence-based decision-making, aimed at responding effectively to economic shifts.

The Need for Timeliness in Monetary Policy

One of Ueda's key points is the importance of conducting monetary policy in a timely and appropriate manner. He noted that the Bank of Japan must be flexible and responsive to economic changes, avoiding a rigid adherence to predetermined schedules. This responsiveness is crucial in navigating various uncertainties that can impact economic conditions.

Conclusion: What This Means for Economic Stakeholders

The potential for rate hikes signals a cautious but proactive stance from the Bank of Japan. Investors, businesses, and consumers alike should stay attuned to these developments, as changes in interest rates can have wide-ranging implications for borrowing costs, investment strategies, and overall economic activity.

As the BOJ moves forward, continued monitoring of inflation trends and economic indicators will be essential in determining its next steps.

Leave a comment

All comments are moderated before being published.

यह साइट hCaptcha से सुरक्षित है और hCaptcha से जुड़ी गोपनीयता नीति और सेवा की शर्तें लागू होती हैं.