Bitcoin: A Global Asset in the Eyes of BlackRock CEO

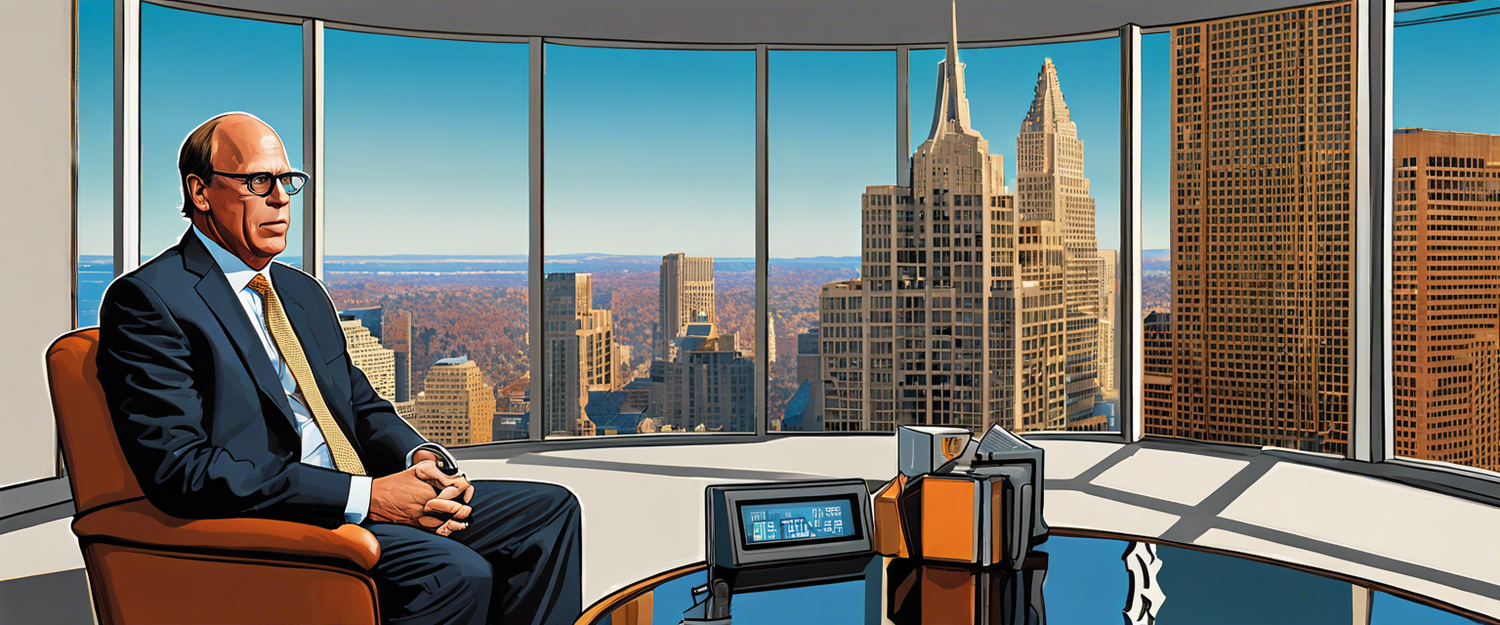

On December 1, during an exclusive interview with Fox, Larry Fink, the CEO of BlackRock, shared valuable insights regarding Bitcoin. He outlined his belief that Bitcoin is an international asset, emphasizing its independence from any single nation's currency. This perspective highlights the growing recognition of Bitcoin's global relevance and its potential role in the international financial landscape.

The Rise of Bitcoin as a Borderless Asset

Fink's comments arrive at a pivotal moment when digital currencies are increasingly becoming a topic of discussion in financial circles globally. The notion of Bitcoin existing as a borderless asset fits neatly within the broader trend of cryptocurrencies gaining traction as alternative investment vehicles. This paradigm shift not only marks a turning point for Bitcoin but also for the entire cryptocurrency ecosystem.

Integration of Digital Assets by Traditional Financial Institutions

The continuous exploration by traditional financial institutions regarding the integration of digital assets into their frameworks is evident. Digital assets have grown from a niche interest to a viable component of investment strategies and financial portfolios. Fink's remarks reveal a significant acknowledgment from one of the world’s leading asset management firms regarding the importance of these digital currencies.

Implications for Investors

- Diversification: Bitcoin provides investors a means to diversify their portfolios beyond traditional assets.

- Global Reach: Fink's perspective underscores Bitcoin's potential to facilitate transactions and investments across borders.

- Market Stability: As more institutions consider Bitcoin, its market stability may improve, attracting more long-term investors.

Conclusion

As Bitcoin continues to gain traction in the financial landscape, leaders like Larry Fink play a crucial role in shaping perceptions of these digital assets. His comments reaffirm the notion that Bitcoin is not just a speculative investment but a legitimate player in the global economic framework. As we move forward, it will be interesting to see how digital currencies evolve and how traditional finance continues to adapt to these changes.

اترك تعليقًا

تخضع جميع التعليقات للإشراف قبل نشرها.

This site is protected by hCaptcha and the hCaptcha Privacy Policy and Terms of Service apply.